The Plantronics Voyager Legend is a premium wireless Bluetooth headset designed for seamless communication. Known for its exceptional audio quality, ergonomic design, and advanced noise-canceling technology, it offers a reliable solution for professionals and everyday users alike. With intuitive controls and long-lasting battery life, this headset delivers unmatched comfort and performance.

1.1 Overview of the Headset

The Plantronics Voyager Legend is a high-performance Bluetooth headset designed for crystal-clear audio and all-day comfort. Featuring advanced noise-canceling technology, it ensures precise sound reproduction in any environment. With a sleek, ergonomic design and intuitive controls, this headset offers a seamless user experience. Its robust build and long-lasting battery make it ideal for professionals seeking reliable communication solutions on the go.

1.2 Key Features and Benefits

The Plantronics Voyager Legend boasts advanced noise-canceling technology, ensuring clear audio in noisy environments. It features voice alerts, multipoint connectivity, and intuitive controls for seamless call management. The ergonomic design provides all-day comfort, while the long-lasting battery offers reliable performance. With its sleek appearance and robust functionality, this headset is tailored for professionals seeking a hands-free, high-quality communication experience on the go.

Unboxing and Accessories

The Voyager Legend comes with a charging case, USB cable, and multiple eartip sizes. Additional accessories like a desktop charger and travel pouch are available separately.

2.1 What’s in the Box

The Plantronics Voyager Legend box includes the headset, a charging case, USB charging cable, and three sizes of eartips for a personalized fit. Additional accessories like a desktop charger and travel pouch may be available separately, depending on the package. These items ensure convenience, portability, and optimal performance for users on the go.

2.2 Compatible Accessories

The Plantronics Voyager Legend supports a range of compatible accessories, including a charging case, USB charging cable, and additional eartips for comfort. Optional accessories like a desktop charger and travel pouch enhance portability. These extras ensure users can maintain connectivity and convenience, whether in the office or on the move, with seamless integration and extended functionality.

Headset Overview

The Plantronics Voyager Legend is a sleek, single-ear Bluetooth headset featuring advanced noise-canceling technology, ergonomic design, and intuitive voice controls for seamless communication and audio streaming.

3.1 Design and Ergonomics

The Plantronics Voyager Legend features a sleek, ergonomic design with a lightweight, comfortable fit. Its adjustable ear tip ensures a secure placement, while the pivoting microphone allows for natural speech. The headset is designed to be worn on either ear, offering versatility for users. The noise-canceling microphone enhances call clarity, and the intuitive controls provide easy access to essential functions, making it ideal for all-day wear.

3.2 Sensors and Indicators

The Voyager Legend features advanced sensors for seamless functionality, including play/pause controls and call management. The headset includes LED indicators for pairing status, charging, and battery levels. These sensors and indicators ensure intuitive operation, providing visual and audible feedback to keep users informed. The design integrates these elements subtly, maintaining a sleek and professional appearance while enhancing user experience through smart technology integration.

Pairing the Headset

Pairing the Voyager Legend is straightforward, using Bluetooth technology for secure connections. It supports multipoint pairing, allowing use with two devices simultaneously, enhancing convenience and productivity seamlessly.

4.1 First-Time Pairing

To pair the Voyager Legend for the first time, turn it on and enter pairing mode by holding the call button until the LED flashes red and blue. Open your device’s Bluetooth settings and select “Plantronics Voyager Legend” to complete the connection. The headset will confirm pairing with a voice alert and LED confirmation, ensuring a secure and quick setup process.

4.2 Pairing with Another Phone

To pair the Voyager Legend with another phone, ensure it is in pairing mode by holding the call button until the LED flashes red and blue. On the second device, go to Bluetooth settings and select “Plantronics Voyager Legend.” The headset supports multipoint technology, allowing connection to two devices simultaneously. The LED will confirm pairing, and voice alerts will guide you through the process seamlessly.

Charging and Battery Life

The Voyager Legend features advanced battery technology, offering up to 24 hours of talk time. It charges via USB or the included charging case, with LED indicators showing charge status. Voice alerts notify you when the battery is low, ensuring uninterrupted use throughout the day.

5.1 Charging Methods

The Voyager Legend can be charged using the included USB cable or the portable charging case. Connect the USB cable to a power source or insert the headset into the case for convenient charging. LED indicators on the headset and case show charging progress, ensuring you never run out of power unexpectedly.

5.2 Battery Life and Management

The Voyager Legend offers up to 7 hours of talk time and 11 days of standby on a single charge. Voice alerts notify you of low battery, while LED indicators provide visual cues. To extend battery life, store the headset in the charging case when not in use and avoid extreme temperatures. Regular charging helps maintain optimal performance and longevity.

Fit and Comfort

The Voyager Legend features an ergonomic design with customizable eartips for a secure, comfortable fit. It can be worn on either ear, ensuring all-day wearability and convenience.

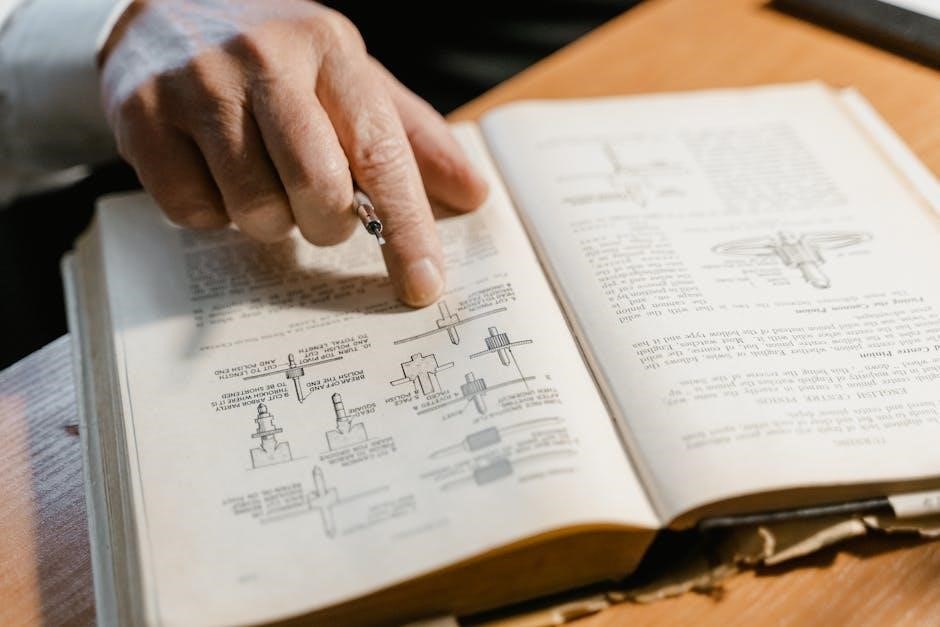

6.1 Changing the Eartip

To change the eartip, gently pull the existing one away from the headset. Select the desired size from the provided options and align it with the speaker. Push firmly until it clicks into place. Proper fit ensures optimal comfort and audio performance. Multiple sizes are included to suit different ear shapes, enhancing both stability and sound quality during extended use.

6.2 Wearing on the Left or Right Ear

The Plantronics Voyager Legend is designed for versatility, allowing you to wear it on either ear. To switch ears, simply rotate the boom and adjust the headset for a secure fit. The ergonomic design ensures comfort and stability on either side. For optimal performance, pair the headset with the correct eartip size and position it snugly in your ear.

Basic Functionality

The Voyager Legend enables seamless call management, including making, answering, and ending calls. It also features intuitive mute and volume controls for enhanced user experience.

7.1 Making, Taking, and Ending Calls

The Voyager Legend simplifies call management with intuitive controls. To make a call, use voice commands or dial from your paired device. Answer incoming calls by tapping the Call button, and end calls by tapping it again. The headset also supports rejecting calls and accessing voice dialing. Additionally, you can mute calls and adjust volume during calls for better control.

7.2 Muting and Adjusting Volume

Muting calls on the Voyager Legend is simple—press and hold the Mute button until the LED flashes red. To unmute, press and hold it again. Adjust volume using the + and ⎻ buttons on the headset. The LED will indicate volume levels, and the headset automatically adjusts audio to optimize sound quality in noisy environments, ensuring clear communication at all times.

Advanced Features

The Voyager Legend offers voice alerts for notifications and commands, enabling hands-free control. Customize settings via Plantronics Hub, enhancing functionality and personalizing your experience for optimal convenience and control.

8.1 Voice Alerts and Commands

The Voyager Legend features voice alerts for notifications, such as battery status, connection updates, and call alerts. Users can utilize voice commands to manage calls, adjust settings, and access features hands-free. This enhances convenience and ensures a seamless user experience, allowing for efficient control without manual adjustments. The voice alerts and commands are customizable through the Plantronics Hub app, providing personalized functionality.

8.2 Customizing Your Headset

The Voyager Legend allows for extensive customization through the Plantronics Hub app. Users can adjust settings like voice alerts, button functions, and equalizer preferences to tailor their experience. Firmware updates can also be installed to enhance functionality and ensure optimal performance. This level of personalization enables users to maximize comfort, productivity, and audio quality according to their specific needs and preferences.

Using Sensors

The Voyager Legend’s sensors detect when it’s worn, allowing automatic audio playback control and seamless call management, enhancing the overall user experience.

9.1 Play or Pause Streaming Audio

The Voyager Legend’s sensors detect when the headset is put on or removed, allowing automatic play or pause of streaming audio. This feature enhances convenience, eliminating the need for manual controls. When you take off the headset, audio pauses, and resumes seamlessly when you put it back on, ensuring uninterrupted listening and optimal user experience.

9.2 Sensor-Based Call Management

The Voyager Legend’s sensors enable seamless call management by detecting when the headset is worn or removed. Automatically answering or ending calls, these sensors enhance convenience and reduce manual interaction. When you put on the headset, incoming calls are answered, and removing it ends the call, ensuring a smooth and intuitive user experience tailored for hands-free communication.

Multipoint Technology

Multipoint technology allows the Voyager Legend to connect to two Bluetooth devices simultaneously, enabling seamless switching between calls on different devices for enhanced productivity and convenience.

10.1 Connecting to Multiple Devices

The Voyager Legend supports multipoint technology, enabling connection to two Bluetooth devices simultaneously. To connect the first device, ensure Bluetooth is enabled and select the headset. For the second device, pair it after the first connection is established. This feature allows seamless switching between calls or audio on different devices, enhancing productivity and convenience for users juggling multiple tasks or devices. Use the Plantronics Hub app for customization.

10.2 Managing Connections

The Voyager Legend allows easy management of connections between two paired devices. Users can switch between active calls or audio streams by using voice commands or physical buttons. The headset prioritizes the last connected device but can be manually switched using the controls. Additionally, the Plantronics Hub app provides settings to customize connection preferences, ensuring a seamless and efficient experience across multiple devices.

Customization and Settings

The Plantronics Voyager Legend offers customization through the Plantronics Hub app, enabling users to personalize settings, voice alerts, and firmware updates for enhanced functionality and optimal performance.

11.1 Using Plantronics Hub

The Plantronics Hub software allows users to customize their Voyager Legend headset settings, including voice alerts, call notifications, and device preferences. It simplifies firmware updates and provides a centralized platform to tailor the headset to individual needs, ensuring optimal performance and personalized functionality. The Hub is compatible with both desktop and mobile devices, enhancing the overall user experience.

11.2 Updating Firmware

Updating the firmware of your Plantronics Voyager Legend ensures optimal performance and access to the latest features. Connect the headset to your computer, launch the Plantronics Hub software, and check for updates. Follow the on-screen instructions to download and install the new firmware. This process is essential for maintaining compatibility and enhancing functionality, and it should not be interrupted once started.

Troubleshooting Common Issues

Resolve connectivity or audio issues by resetting the headset or ensuring proper pairing. Check settings, update firmware, and clean the device for optimal performance.

12.1 Connectivity Problems

If experiencing connectivity issues, ensure Bluetooth is enabled on your device and the headset is in pairing mode. Reset the headset by holding the call button for 5 seconds. Verify the device is within range and restart both devices. Check for firmware updates and ensure no interference from other devices. If issues persist, consult the user manual or contact support.

12.2 Audio Quality Issues

If experiencing muffled sound or distortion, ensure the eartip is properly fitted and free from debris. Check the microphone for dirt or obstructions. Restart the headset and device, and verify firmware is up-to-date. If issues persist, reset the headset by holding the call button for 5 seconds. Consult the user manual for additional troubleshooting steps or contact support for assistance.

Maintenance and Care

Regularly clean the headset with a soft cloth and store it in a protective case. Avoid extreme temperatures to maintain battery performance and overall durability.

13.1 Cleaning the Headset

Regularly clean the headset using a soft, dry cloth to remove dirt and oils. Avoid harsh chemicals or moisture, as they may damage the device. Gently wipe the ear tips, microphone, and exterior surfaces. For stubborn stains, dampen the cloth slightly but ensure no moisture enters the headset. This maintains hygiene and ensures optimal performance and longevity of your Voyager Legend.

13.2 Storage and Travel Tips

Store the headset in a protective case or pouch to prevent scratches and damage. Avoid extreme temperatures and moisture. When traveling, use the included charging case to keep the headset charged and organized. Ensure the headset is dry before storing to prevent mold or corrosion. For extended storage, charge the battery to 50% to maintain its health. Always handle the headset with care to ensure longevity.

Warranty and Support

The Plantronics Voyager Legend is backed by a limited warranty covering manufacturing defects. For support, visit the official Plantronics website or contact their customer service team directly.

14.1 Warranty Information

The Plantronics Voyager Legend is covered by a limited warranty that protects against manufacturing defects. The standard warranty period is one year from the date of purchase. This warranty includes repairs or replacements for defective materials or workmanship. For detailed terms and conditions, refer to the user manual or visit the official Plantronics website.

14.2 Contacting Customer Support

For assistance with your Plantronics Voyager Legend, contact customer support via phone at 1-855-765-7878 or visit the official website. Support is available in multiple languages, and the website offers live chat, FAQs, and downloadable resources. Ensure to have your product serial number ready for efficient service. Visit www.poly.com for more details and support options.

The Plantronics Voyager Legend is a reliable and advanced Bluetooth headset, offering exceptional audio quality, comfort, and intuitive features. Follow the guide for optimal performance and satisfaction.

15.1 Final Tips for Optimal Use

- Regularly update your headset’s firmware for improved performance.

- Use the Plantronics Hub app to customize settings and voice alerts.

- Keep the headset clean and store it in the charging case when not in use.

- Explore advanced features like multipoint technology for seamless connectivity.

- Adjust the fit and volume for maximum comfort and audio clarity.

15.2 About Plantronics and the Voyager Legend

Plantronics, now part of Poly, is a global leader in audio and video communications. The Voyager Legend is one of their most popular headsets, renowned for its Bluetooth connectivity, noise-canceling microphone, and ergonomic design. Designed for professionals and everyday users, it combines comfort, reliability, and advanced features to deliver exceptional communication experiences.